Inverted Yield Curve: Causes, Analysis, and Investment Strategy

Project Overview

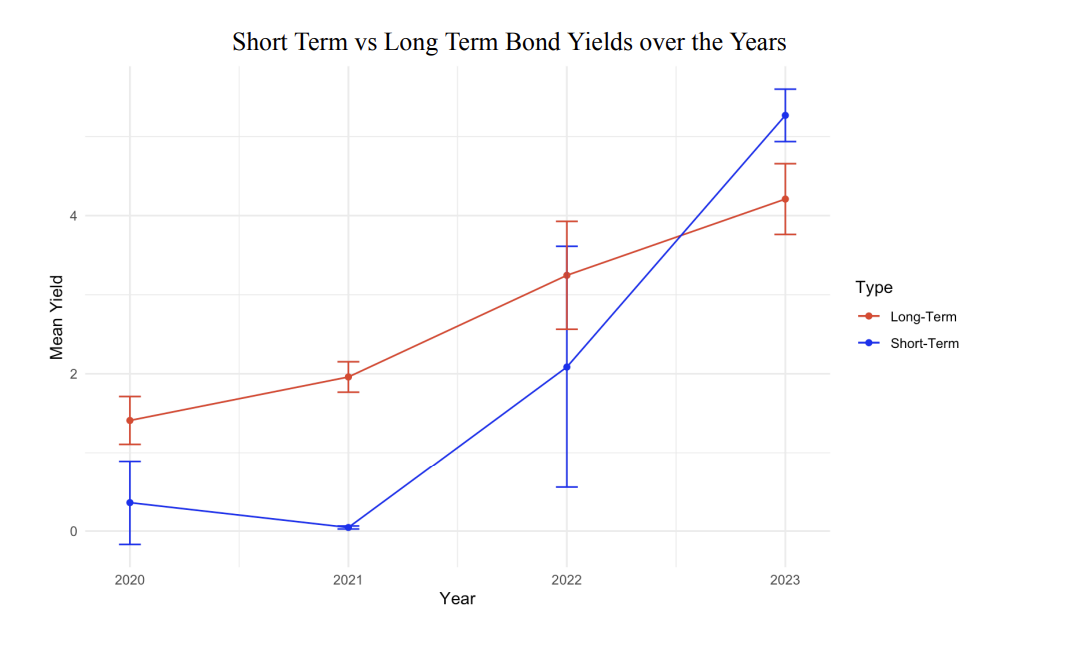

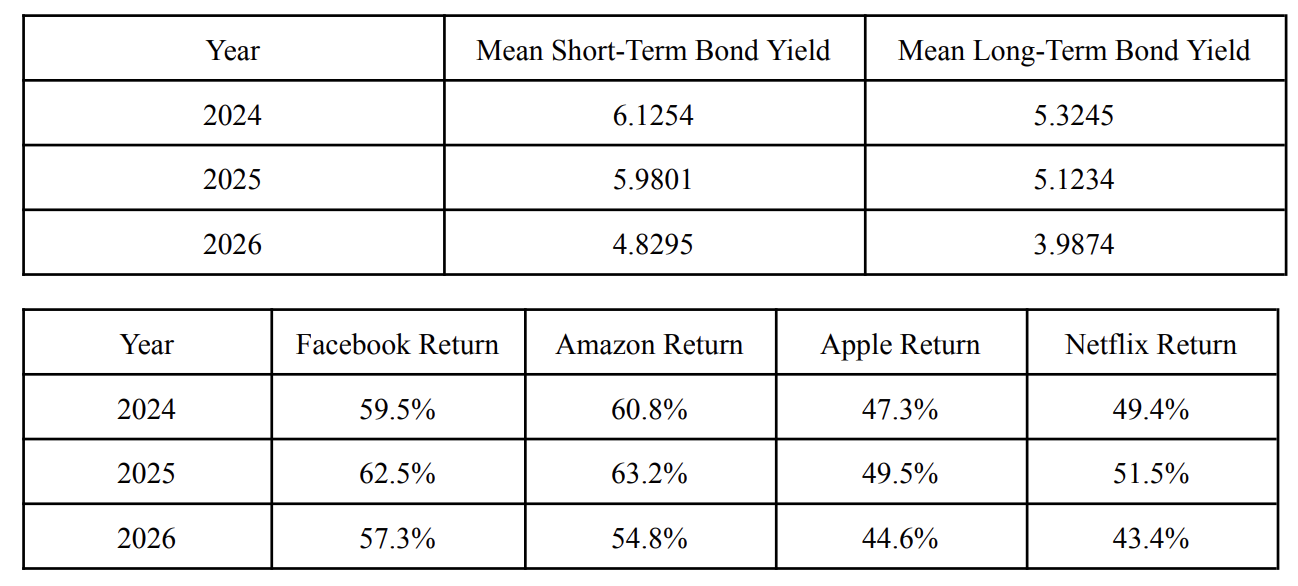

This project investigates the inverted yield curve—a financial phenomenon where short-term bonds yield higher returns than long-term bonds, signaling potential economic downturns. This project aimed to identify the causal factors behind this trend, assess its implications, and explore optimal investment strategies in the context of 2023’s economic climate. Through comprehensive data analysis, including GDP growth, inflation, and interest rates, we developed insights that inform portfolio strategies favoring short-term bonds and FAAN stocks (Facebook, Apple, Amazon, and Netflix).

Understanding the Inverted Yield Curve

Causes and Methodology

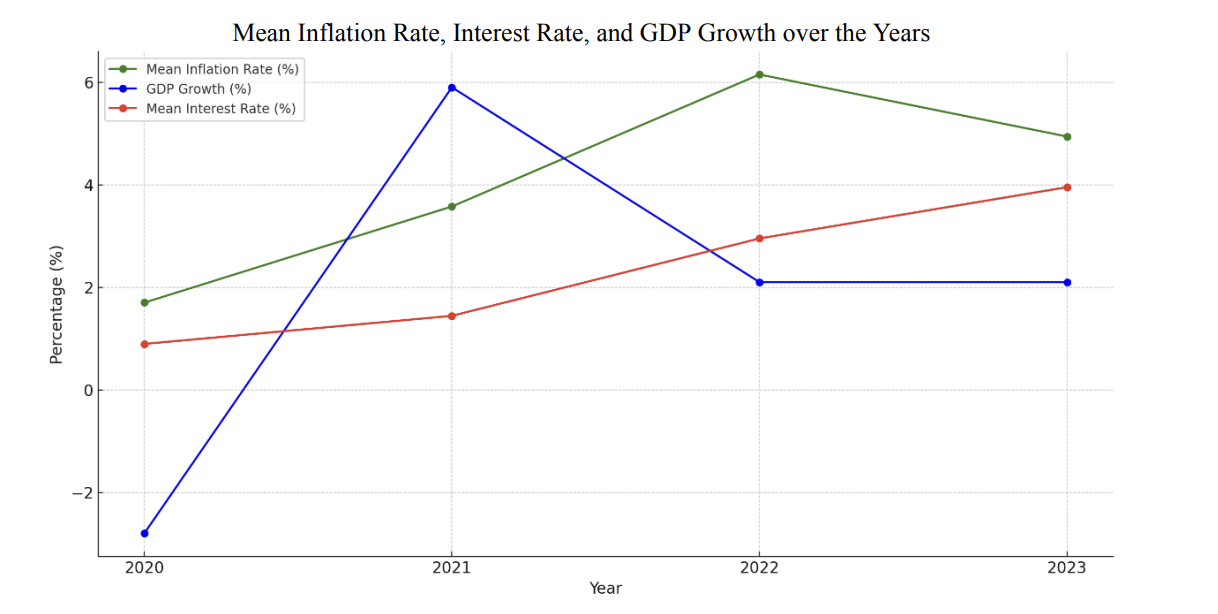

The analysis centered on three economic indicators that significantly affect bond yields:

- GDP Growth: A growth threshold of 1.83% was identified to differentiate economic expansion from contraction, significantly impacting bond yields.

- Inflation: Set at 3%, this threshold distinguishes between moderate and high inflation, influencing bond yield behaviors and investor expectations.

- Interest Rates: A threshold of 2% was set to analyze periods of higher and lower rates and their effect on short- and long-term yields.

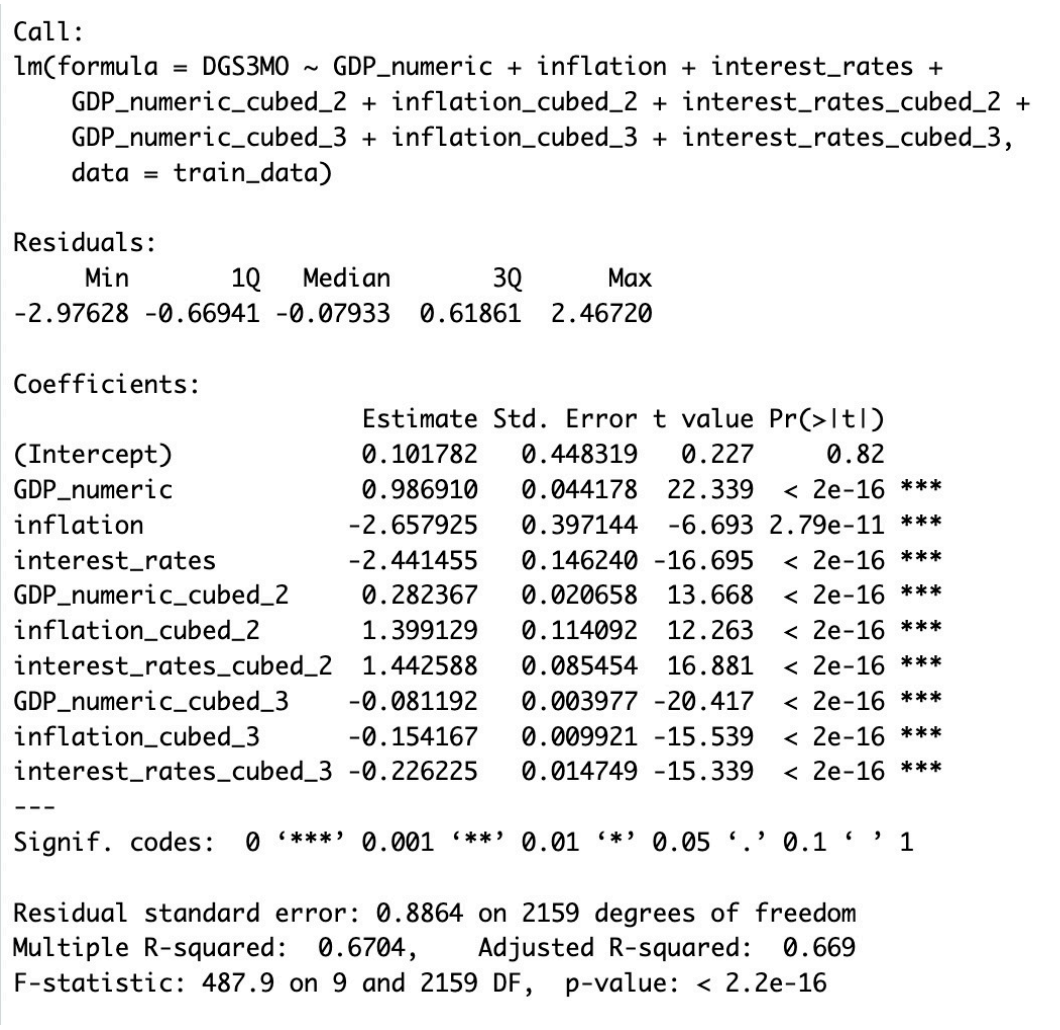

Through statistical analysis, including Bayes’ theorem and polynomial regression, we explored the relationships between these indicators and bond yields. Bayesian methods helped establish the likelihood that one economic indicator could be predictive of another, while polynomial regression provided a nuanced view of these dynamics in relation to bond yields.

Key Findings

Some key findings from our analysis include:

- Statistical evidence showed short-term bonds would likely outperform long-term bonds in the near term, with short-term yields peaking in 2024 and an expected recession by 2025.

- Bayesian analysis revealed that inflation, GDP growth, and interest rates are interconnected, affecting bond yields. For instance, higher inflation typically corresponded with lower long-term yields but higher short-term yields, highlighting a shift in investor sentiment.

- ANOVA testing showed a statistically significant performance difference between portfolios composed of short-term bonds and FAAN stocks versus long-term bonds, confirming the investment strategy favoring short-term bonds in uncertain economic periods.

Conclusion and Future Directions

This project demonstrates that short-term bonds and FAAN stocks provide a more favorable portfolio mix during times of economic uncertainty marked by an inverted yield curve. Future research could include non-quantitative factors, such as monetary policy changes and market sentiment, to increase the accuracy of economic predictions. Moreover, further analysis into the interdependencies of economic indicators could reveal deeper insights into yield curve dynamics and improve investment strategy formation.